Why choose MAINLAND DUBAI Company ?

Dubai mainland license is required for businesses that operate within the geographic boundaries of Dubai mainland. This type of license allows businesses to conduct commercial activities in Dubai’s local market and beyond, without any restrictions.

Obtaining a Dubai mainland license also provides businesses with a range of benefits, such as the ability to rent office space anywhere in Dubai mainland, the ability to sponsor employees and family members for visas, and the ability to apply for bank accounts and other financial services.

In summary, obtaining a Dubai mainland license is essential for businesses operating in Dubai’s local market, as it allows them to comply with local regulations, operate legally, and access a range of benefits.

Happy To Meet & discuss on Dubai mainland company formation cost

Why choose F&F for incorporating your entity in Mainland Dubai?

We are a registered LLC in Mainland Dubai and offer you unmatched assistance with incorporation. To make sure you pick the best business structure that satisfies your unique needs and goals, we undertake research and offer you competent assistance. We make sure the process is hassle-free and give you the most recent information available.

Mainland - Dubai

Seeking to conduct business in the UAE

Cost effective for 1 Visa + 1 Activity

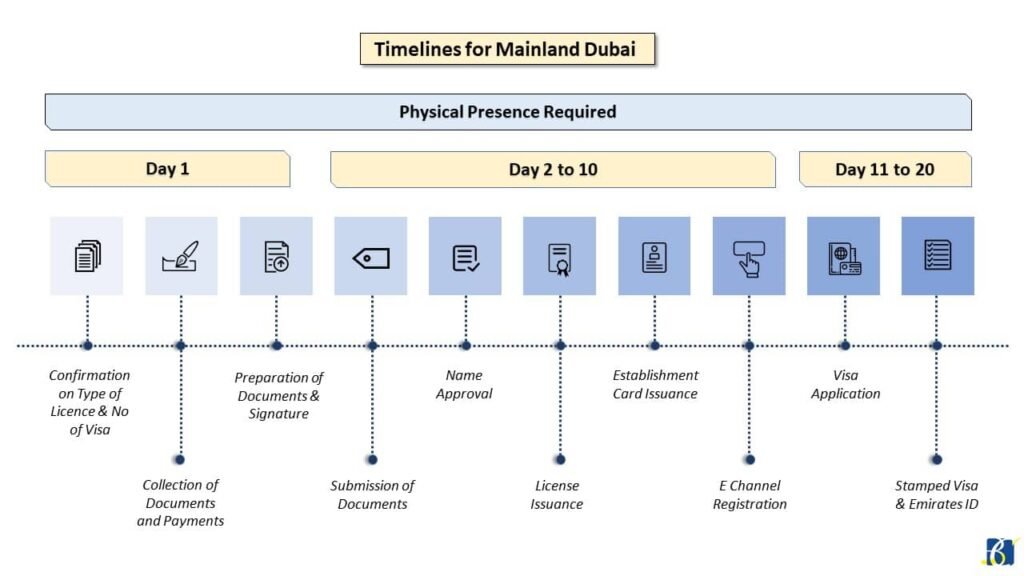

Physical presence of Shareholders is required during the Setup process

A Lease agreement of office is required during the Setup process

Corporate Office / Establishment can be opened in Mainland Dubai

Bank Account opening with having a physical office

Corporate Tax is at 9% on all transactions

How Mainland Dubai is beneficial for entities looking to set up their base in UAE?

Quick & Easy Incorporation

Establishing a legal corporation in Dubai’s mainland is quick and easy.

100% Ownership

Expats will be able to own 100% of businesses in Mainland Dubai after the Commercial Companies Law (CCL) modifications is effective from 1 June 2021.

Customer base is in UAE

In order to conduct any commercial activities in the UAE without restriction, you must obtain a business license in mainland Dubai if you cater to customers or clients who are located within UAE.

Physical Presence

Shareholders must be present in person during the setup procedure.

Physical office

Opening a banking account and the setup process both require a physical office. We can help you locate a Business Center with a very affordable minimal office.

Paid Up Share Capital

You must own at least 300,000 AED worth of Share capital amount in MOA. However, depositing this sum in the business’s bank account is not necessary. Without having to invest a lot of money, you may easily launch your business. Start how you wish to, then develop as you require.

Corporate Tax

If company earnings exceed 375,000, the tax rate is 9%. However, in accordance with Ministerial Decision No. 73 of 2023 on Small Business Relief, there will not be any corporate tax if the revenue for the applicable tax period and previous tax periods was less than AED 3 million.

Pricing (Visa Cost)

- One Visa

- Two Visa

1st Year

-

Initial Application & Name Approval

AED 1,000 -

MOA

AED 1,800 -

1 Trade License & 1 Activity (Approximate)

AED 14,000 -

Virtual Office

AED 7,000 -

Establishment Card

AED 1,800 -

Investor Visa -2 years Validity {Medical, EID, Change Status, Visa Category – Investor & Visa Fee}

AED 6,200 -

Service Charges

AED 4,000

2nd Year

-

–

-

–

-

1 Trade License & 1 Activity (Approximate)

AED 14,000 -

Virtual Office

AED 7,000 -

Establishment Card

AED 1,800 -

–

-

Service Charges

AED 2,500

1st Year

-

Initial Application & Name Approval

AED 1,000 -

MOA

AED 1,800 -

1 Trade License & 1 Activity (Approximate)

AED 14,000 -

Virtual Office

AED 7,000 -

Establishment Card

AED 1,800 -

Investor Visa -2 years Validity {Medical, EID, Change Status, Visa Category – Investor & Visa Fee}

AED 12,400 -

Service Charges

AED 4,000

2nd Year

-

–

-

–

-

1 Trade License & 1 Activity (Approximate)

AED 14,000 -

Virtual Office

AED 7,000 -

Establishment Card

AED 1,800 -

–

-

Service Charges

AED 2,500

Types of Licenses - Dubai Mainland (DED)

- Commercial Licenses covering all kind of trading activity.

- Professional licenses covering professions, services, craftsmen & artisans.

- Industrial Licenses for establishing industrial or manufacturing activity.

Mainland Dubai Documentation

Individual Investor/Partner, Director and Manager

With UAE Residence Visa

- Clear scanned passport copy – 6 months validity

- Clear scanned visa page

- Address of the shareholder

- UAE Entry stamp

- Clear scanned Emirates ID

- Passport size photo for all shareholders

Without UAE Residence Visa

- Clear scanned passport copy – 6 months validity

- Entry Stamp copy

- Tourist/Visit Visa Copy

- Passport size photograph

Corporate Shareholder

- Attested by UAE embassy in the home country and MOFA in the Emirates Board resolution appointing director/ manager / Legal Representative

- Attested by UAE embassy in the home country and MOFA in the Emirates License, MOA, Incumbency, Share Certificate etc. of the shareholding company.

- Passport copy of the UBO’s.

- Passport copy of the Manager.

- Visa page of Manager (if UAE resident)

- Address of the authorized signatory

- Passport size photo for the authorized signatory

Connect with Us

Feel free to reach out Fiscal & Fintech. We would be more than happy to host you at our offices.