Why IFZA Freezone to setup Company in Dubai?

The International Free Zone Authority (IFZA) is Co-branded with the Dubai Silicon Oasis Authority. IFZA-Dubai is an investor’s favorite choice for setting up a free zone company.

This free zone’s main objective is to offer low-cost, which encourages the development of new businesses. Additionally, it has a world-class infrastructure facility, and more investor benefits are driving foreign investors to IFZA Dubai.

Happy To Meet You And Discuss on IFZA Dubai Freezone

We F&F are officially a CHANNEL PARTER for International Free Zone Authority (IFZA)!

As a recognized channel partner with IFZA, we provide you with unmatched assistance with entity incorporation. To make sure you pick the best free zone and set up your business in a way that satisfies your unique needs and goals, we undertake research and offer you expert assistance. We make sure the process is hassle-free and give you the most recent information available.

How IFZA is beneficial for entities looking to set up their base in Dubai?

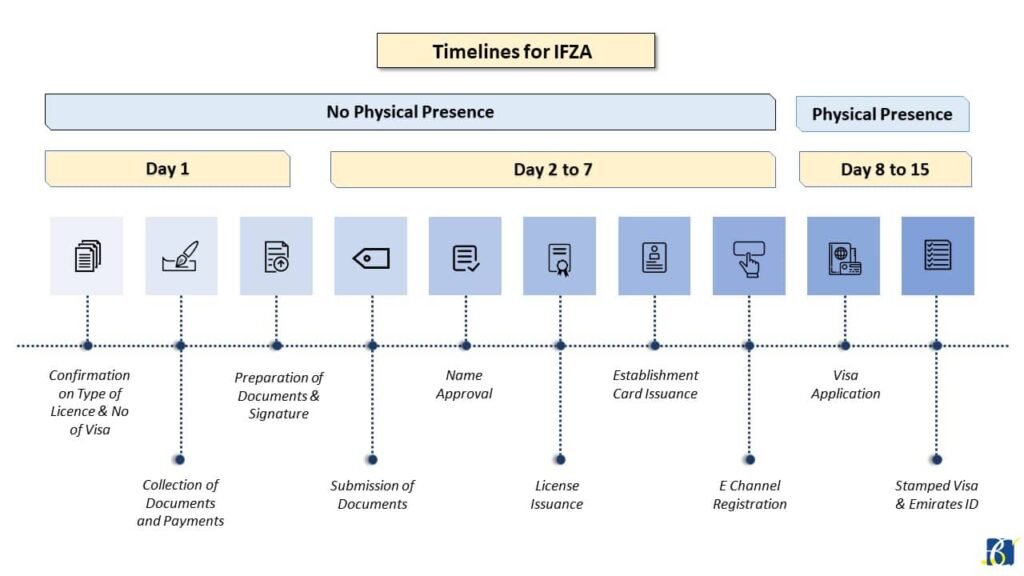

Quick & Easy Incorporation

It is simple and very easy to incorporate an entity in IFZA.

Cost effective for multiple Activities

If you decide to include numerous activities under a single license, there are no extra fees.

Physical Presence

Shareholders DO NOT need to be present physically during the setup process.

No physical office

Opening a banking account and the company setup process don’t require a physical office.

Zero Paid Up Share Capital

Easily start your business without laying down large sums of money. Start how you want and grow as you need.

Flexibility on Number of Visas

Whether you need 4 visas or none, you can choose what suits your business needs.

Flexibility to open offices in mainland

Corporate Office (other than Commercial establishment) can be opened in Mainland Dubai with NOC

No Corporate Tax

Corporate Tax is at 9% applicable for transactions only with mainland.

Pricing (IFZA Visa Cost)

- One Visa

- Two Visa

1st Year

-

License fees + Name Reservation

AED 15,400 -

Establishment Card

AED 2,000 -

Visa Cost with 2 years Validity

AED 3,750 -

Medical & Emirates Id

AED 2,250 -

Medical Insurance

AED 1,000 -

Service Charges

AED 999

2nd Year

-

License Fees

AED 14,900 -

Establishment Card

AED 2,200 -

–

-

–

-

–

-

Service Charges

AED 999

1st Year

-

License fees + Name Reservation

AED 17,400 -

Establishment Card

AED 2,000 -

Visa Cost with 2 years Validity

AED 7,500 -

Medical & Emirates Id

AED 4,500 -

Medical Insurance

AED 2,000 -

Service Charges

AED 999

2nd Year

-

License Fees

AED 16,900 -

Establishment Card

AED 2,200 -

–

-

–

-

–

-

Service Charges

AED 999

Documentation

Individual Investor/Partner, Director and Manager

With UAE Residence Visa

- Clear scanned passport copy – 6 months validity

- Clear scanned visa page

- Address of the shareholder

- UAE Entry stamp

- Clear scanned Emirates ID

- Passport size photo for all shareholders

Without UAE Residence Visa

- Clear scanned passport copy – 6 months validity

- Entry Stamp copy

- Tourist/Visit Visa Copy

- Passport size photograph

Corporate Shareholder

- Attested by UAE embassy in the home country and MOFA in the Emirates Board resolution appointing director/ manager / Legal Representative

- Attested by UAE embassy in the home country and MOFA in the Emirates License, MOA, Incumbency, Share Certificate etc. of the shareholding company.

- Passport copy of the UBO’s.

- Passport copy of the Manager.

- Visa page of Manager (if UAE resident)

- Address of the authorized signatory

- Passport size photo for the authorized signatory

Connect with Us

Feel free to reach out Fiscal & Fintech. We would be more than happy to host you at our offices.