Corporate Tax Advisory Dubai

“When grappling with the complexities of taxation, rest assured, we comprehend both the intricacies and your concerns!”

Tax management stands as one of the most daunting tasks for any organization, requiring meticulous attention to detail and strategic structuring. Yet, a well-handled tax strategy not only mitigates financial risks and minimizes liabilities but also bolsters the organization’s reputation. Our comprehensive tax service suite at F&F offers a holistic approach to optimizing your organization’s tax structure.

Happy To Discuss on VAT Registration Services Dubai

Fiscal & Fintech Accounting Firm

Key Stats

Tax Structuring Dubai

Proper structuring of tax creates a regulated framework for all your tax payments and trading arrangements. It helps in reducing a range of direct and indirect tax your organization is required to pay. A perfect tax plan aligns with its corporate strategy or business framework, and includes identification of tax risks.

Tax Filing Dubai

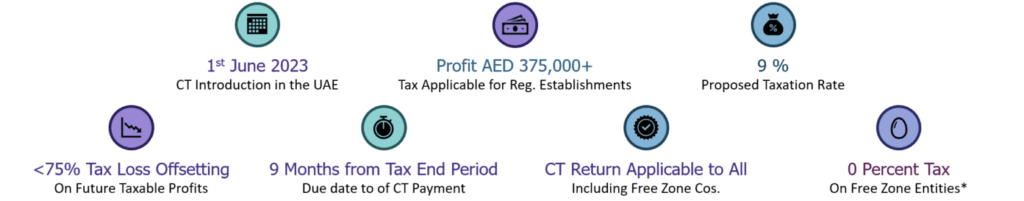

Filing proper tax returns on time with adherence to both national and international tax governance bodies (FTA, CSR, etc.) lets you off the penalties and legal proceedings. A business subject to CT will need to register with the FTA and obtain a Tax Registration Number within the prescribed period. The Tax return and the CT payment must be made within nine (9) months from the end of the relevant Tax Period.

Corporate Tax Filing Services:

- Providing corporate tax registration services to all businesses.

- Preparing and assisting in the filing of corporate tax returns.

- Providing tax accounting services to streamline the accounts as per CT regulations.

Overview:

The United Arab Emirates, which houses significant corporate gateway of Dubai, will have one of the lowest corporate tax rates in the world. This proposal stems from the UAE’s intention to comply with international tax rules, reflecting similar efforts in other Gulf nations, while reducing regulatory burdens for UAE firms and protecting small businesses and start-ups.

Effective Date:

The UAE has decided to introduce Corporate Income Tax (CIT) on business profits in the country. It will be effective for financial years starting on or after June 2023.

Corporate Tax Rates in UAE :

The following are the proposed corporate tax rates:

- A 0% tax rate applies to taxable income up to AED 375,000

- A 9% tax rate applies to taxable income over AED 375,000

- All multinational corporations subject to OECD Base Erosion and Profit-Sharing laws that belong within Pillar 2 of the BEPS 2.0 framework, i.e. combined worldwide revenues in excess of AED 3.15 billion (€750m) will be entitled to varying rates

Key Takeaways from UAE Corporate Law:

- Law not applicable to Individual’s Salary Income, Dividend Income, Capital gains, Rental Income (Passive Incomes)

- Free Zones that do not operate a business with the mainland will be getting the benefit of corporate tax incentives depending on the respective Free Zone regulations. An yearly CIT return is required to be submitted for all free zones

- Non-residents are subject to tax on UAE sourced income and taxable income form PE in the UAE

- Transfer pricing as per the OECD guidelines is applicable. Transactions with owners, directors, officers, etc. shall be as per Arms’ Length Price.

- TP benchmarking study to be conducted for determining ALP, mandated by every Company.

- Any foreign Corporate Tax imposed on UAE taxable income shall be allowed as a tax credit against its annual tax liability.

- Domestic, cross-border payments and specified transactions are subject 0% withholding tax (WHT).

Corporate Tax Impact Assessment Study

- An initial assessment of the corporate tax impact as per the current operational structure of the company will be performed.

- This will be followed by a system impact analysis which would include analysing the data that is required to be collated for corporate tax requirements and would include understanding whether the same is being captured by the existing systems in place.

Tax Advisory Services in Dubai

- Assessing and advising on tax implications for the company

- Assessing the eligibility of corporate tax and advising on corporate tax exemptions to the mainland, offshore as well as free zone businesses, if any

- Assessing and analyzing the possibility of tax grouping of the companies to avail tax benefits

- Advising on the restructuring of group companies including foreign subsidiaries/branches

- Advising on the possibility of foreign tax credits, withholding tax and deduction of expenses and interest

At F&F, we understand the intricacies of the corporate tax landscape. Our expert team of advisors goes beyond simple compliance, offering a comprehensive suite of corporate tax advisory services designed to optimize your financial health and navigate today’s complex tax environment.

Here’s how we empower your business:

-

Strategic Tax Planning:

We delve deep into your operations, meticulously assessing the advantages and disadvantages of your activities. This in-depth analysis forms the foundation for developing a customized tax plan that minimizes your liabilities and maximizes your profitability.

-

Seamless Corporate Tax Registration Services:

Navigate the registration process with ease. We handle every step, ensuring accurate and efficient registration, allowing you to operate seamlessly from day one.

-

Flawless Corporate Tax Filing Services:

No more late nights or error-ridden forms. Our experienced professionals handle the entire filing process with meticulous attention to detail, maximizing deductions and minimizing potential errors.

-

Unwavering Corporate Tax Compliance Services:

Stay ahead of the curve with our proactive approach. We closely monitor evolving regulations and keep you informed, ensuring your business remains fully compliant year-round.

But our expertise extends beyond just compliance:

-

Expert Documentation Guidance:

With the latest amendments in tax law always at our fingertips, we advise on preparing accurate and complete documentation, minimizing the risk of audits and inaccuracies.

-

Rigorous Submission Scrutiny:

Our meticulous reviewers carefully scrutinize every submission before it leaves the door, ensuring flawless paperwork and reducing the chances of errors and delays.

Invest in your future:

Choosing F&F’s corporate tax advisory services is more than just outsourcing compliance. It’s a strategic investment in your long-term success. We become your trusted partners, working alongside you to unlock tax efficiency, minimize risks, and optimize your financial performance.Contact us today for a free consultation and discover how our comprehensive corporate tax advisory services can propel your business towards a brighter financial future.

Our Clients

Connect with Us

Feel free to reach out Fiscal & Fintech. We would be more than happy to host you at our offices.