The economic narrative of the GCC countries has historically been written in barrels of oil and cubic meters of gas. However, the developments observed throughout November 2025 show a decisive and irreversible shift in this narrative. We are witnessing the maturation of a sophisticated, interconnected, and increasingly digital fiscal architecture across the region. Tax authorities are moving beyond the initial “implementation phase”, characterized by the rapid rollout of VAT and Excise initiatives between 2017 and 2020, into a “refinement and enforcement phase.” This new era is defined by three distinct pillars: the structural calibration of penalty regimes to encourage voluntary compliance, the aggressive digitization of reporting frameworks to close the VAT gap, and the seamless integration of global tax standards such as the OECD’s Base Erosion and Profit Shifting (BEPS) measures.

This month’s comprehensive analysis focuses on the pivotal legislative changes that have reshaped the compliance landscape. In the United Arab Emirates (UAE), the Cabinet has fundamentally restructured the administrative penalty system, abandoning punitive compounding fines in favor of an interest model.

The November 2025 edition of our monthly Tax Roundup serves as an exhaustive reference document. It offers tax directors, legal counsel, and financial officers the insights required to operate in a region that is fast becoming one of the most dynamic fiscal jurisdictions in the world.

1. United Arab Emirates

The most significant development in November 2025 is the UAE’s overhaul of its administrative penalty framework. The issuance of Cabinet Decision No. 129 of 2025, which amends the longstanding Cabinet Decision No. 40 of 2017, represents a change in how the Ministry of Finance (MoF) and the Federal Tax Authority (FTA) approach non-compliance.

1.1 The Transition from Punitive to Proportionate Governance

Under the previous frameworks (Decision No. 40 of 2017 and Decision No. 49 of 2021), penalties for late payment could compound rapidly. The structure involved a 2% immediate penalty, followed by a 4% monthly penalty, capped at 300% of the tax due. This compounding interest effect meant that a small error, if left undiscovered for several years, could result in a liability three times the original tax amount, potentially bankrupting Small and Medium Enterprises (SMEs).

Cabinet Decision No. 129 of 2025, published in the Official Gazette on November 10, 2025, and effective from April 14, 2026, dismantles this compounding structure.

1.2 Detailed Analysis of the New Penalty Structure

The new decision introduces a simplified, non-compounding penalty regime that harmonizes violations across all tax laws—VAT, Excise, Tax Procedures, and the newly implemented Corporate Tax.2 This unification is critical; previously, discrepancies existed in how penalties were applied across different tax heads. The new “Tax Law” definition explicitly encompasses all these areas, ensuring a consistent application of justice.4

1.2.1 Late Payment and the “Cost of Capital” Model

The most radical change is found in the treatment of late payments. The previous 300% cap has been replaced by a flat 14% per annum rate, accrued monthly on the outstanding tax.

1.2.2 Voluntary Disclosure (VD) Incentives

The decision creates a sophisticated matrix for Voluntary Disclosures, designed to incentivize transparency. The regime distinguishes sharply between disclosures made before an audit notification and those made after.

- Pre-Audit Disclosure: If a taxpayer identifies an error and self-reports before the FTA notifies them of an audit, the penalty is largely limited to the time-value of money (the monthly interest).

- Post-Audit Disclosure: If the VD is submitted after an audit notification is issued, a 15% fixed penalty applies, in addition to the monthly interest.

This represents a significant reduction from the previous 50% fixed penalty for post-notification disclosures. The rationale here is behavioural economics: under the old 50% regime, once an audit was announced, a taxpayer had little incentive to cooperate or disclose errors voluntarily, as the penalty was already maximized. By lowering it to 15%, the FTA leaves a “door open” for cooperation even after the audit process has commenced. It rewards the taxpayer who, upon receiving an audit letter, immediately reviews their books and presents the errors to the auditor, saving the FTA time and resources in discovery.

1.2.3 Procedural Violations

Fixed penalties for administrative oversights have also been slashed.

- First-time violations: Reduced from AED 5,000 to AED 1,000.

- Repeated violations (within 24 months): Reduced from AED 10,000 to AED 5,000.

This reduction acknowledges that many first-time errors, such as filing a return a few hours late, are inadvertent. Punishing these with AED 5,000 fines created friction and resentment without necessarily improving compliance culture. The lower fines maintain the principle of discipline without acting as a revenue-generation tool.

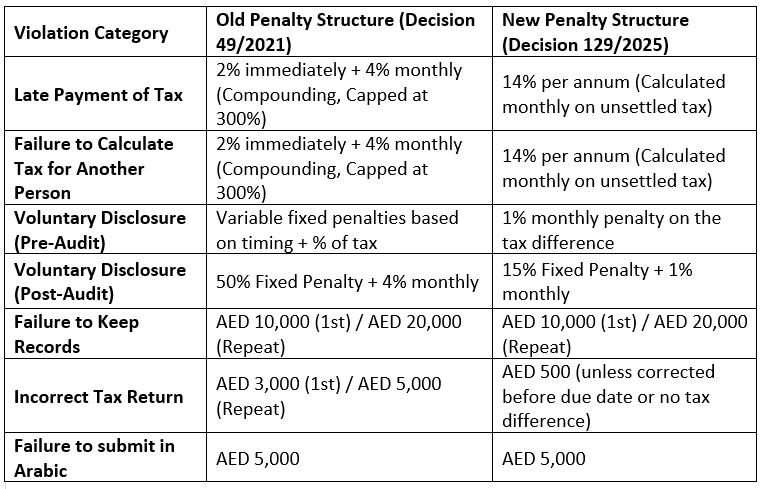

Comparative Analysis of UAE Penalty Regimes

The following table compares the previous (Decision No. 49 of 2021) with the incoming framework (Decision No. 129 of 2025), highlighting the financial implications for businesses.

2. Oman

The Sultanate of Oman is rapidly shedding its image as a quiet follower in GCC tax policy. In November 2025, it took aggressive steps toward digital taxation, distinguishing its fiscal model from its neighbours.

2.1. The E-Invoicing Data Dictionary

In preparation for the mandatory e-invoicing rollout in August 2026, the Oman Tax Authority (OTA) released its draft E-Invoicing Data Dictionary for consultation in November 2025.

This document is the “DNA” of the future tax system. It defines exactly what data must be transmitted to the government in real-time. While the OTA has broadly aligned its standards with the Peppol 5-corner model (a global standard for e-procurement), it has introduced specific “Omanizations”:

- The dictionary includes a framework for generating a Universal Unique Identifier (UUID) and a cryptographic Invoice Hash. This mirrors the security protocols used in Saudi Arabia’s ZATCA Phase 2. It means that once an invoice is generated, it is digitally sealed; any subsequent alteration will break the hash, alerting the tax authority to potential fraud.

- Specific business rules have been drafted for import transactions, linking the invoice to customs declarations.

- Mandatory QR codes will allow customers (and field inspectors) to instantly verify the validity of an invoice using a smartphone.

The release of this dictionary nine months ahead of the August 2026 launch for the Top 100 taxpayers is a best-practice approach. It gives ERP providers (SAP, Oracle, Microsoft) and local software houses sufficient time to build the necessary APIs.

2.2. Excise Tax Expansion

Oman confirmed in November 2025 that the import of soft drinks and energy drinks without a Digital Tax Stamp (DTS) will be banned.

The DTS system is a traceability mechanism. A physical or digital stamp acts as proof that the Excise Tax has been paid. By expanding this from tobacco (the typical target) to sweetened beverages, Oman is closing a significant loophole in its “Sin Tax” regime. It prevents the grey-market importation of sodas from neighboring jurisdictions with lower tax rates or laxer enforcement. This move supports both public health goals (reducing sugar consumption) and revenue integrity.

2.3. Corporate Social Responsibility as Tax Policy

In a unique move, Oman expanded tax deductions for corporate charitable donations in mid-November 2025. Donations to qualifying endowment institutions are now deductible, capped at 5% of total taxable income.

3. Qatar

The General Tax Authority (GTA) in Qatar announced a critical amendment to Withholding Tax forms on November 26, 2025. The amendment requires taxpayers to include a Contract Notification Reference Number on their WHT returns.

This is a powerful anti-avoidance tool. Qatar Law requires that any contract with a non-resident be notified to the GTA within 30 days. However, compliance was historically spotty. By mandating the reference number on the payment form, the GTA has created a hard stop. A taxpayer cannot remit the tax (and thus cannot claim the expense deduction) unless the underlying contract is registered. This forces visibility over all cross-border service agreements, allowing the GTA to assess whether Permanent Establishment (PE) risks are being ignored.

Simultaneously, Qatar extended its 100% Financial Penalty Exemption Initiative until December 31, 2025. With over 7,000 taxpayers already benefiting and QAR 1.6 billion in penalties waived, this program has been highly effective in bringing the “tail” of the economy into the formal tax net.

4. International Developments & Treaties

The GCC does not operate in a vacuum. November 2025 saw key international developments that will ripple through regional domestic laws.

4.1. Kuwait-Jordan Protocol

On November 13, 2025, Kuwait and Jordan signed a protocol amending their 2001 Income Tax Treaty. The amendment aligns the treaty with OECD BEPS standards, specifically regarding the exchange of information. For Kuwaiti investors in Jordan (and vice versa), this provides greater certainty and protection against discriminatory taxation, while closing loopholes that might have allowed for double non-taxation.

4.2. OECD Model Convention 2025

The OECD released the 2025 update to its Model Tax Convention on November 19, 2025. The update includes new commentary on cross-border remote work.

This is highly relevant for the GCC. Cities like Dubai, Doha, and Riyadh are aggressively competing for global talent, offering “Digital Nomad” visas. The new OECD guidance clarifies when a remote worker creates a “Permanent Establishment” for their employer. If a UK employee works remotely from Dubai for 183 days, does the UK company now have a taxable presence in the UAE? The OECD’s updated commentary will likely serve as the interpretive guide for GCC tax authorities when making these determinations in 2026.

The content provided in this newsletter is for general informational purposes only and reflects publicly available information as of November 2025. This material does not constitute and should not be relied upon as legal, tax, accounting, or professional advice. Since laws and regulations in the UAE and GCC are subject to rapid change, readers must consult with a qualified professional advisor before making any decisions based on the information presented. We accept no responsibility or liability for any loss or damage arising from reliance on the content of this publication.